What is the Easiest Way to Budget?

When you decide to start working on your finances, the first thing you need is a general road map of your income, expenses, and what is left over. This road map of how you spend your money is called a budget. It is very tempting to go out and buy a new specialty budget planner, stickers, pens, highlighters, and lots of printable trackers. These items can get very pricey, and I advise you to wait before spending any money on starting a budget.

The super easy beginner budget I am about to show you, can be used by anyone. This budget is going to be the starting point and will help you decide how you want to proceed. The road to financial freedom and getting out of debt is not a quick start and stop trip. It is a very long ride with lots of little stops and adjustments along the way. The length of time that it takes to get financial freedom is going to be different for everyone. Some factors that will affect the length of time are the amount of income that you have, the amount of debt that you owe, and what you are willing to do to make your goals possible.

Some people are willing to skip vacations, stop buying clothes, and making coffee at home for a while, in order to achieve financial freedom. Others are willing to just spend less on these things and take a longer road to freedom. It may seem like an easy thing to cut all spending and just pay off debt, but that actually takes a lot of discipline and practice. You will want to take baby steps!

Does Making a Budget Cost Anything?

In general, making a good first budget does not cost anything. All you need is paper and a pen or a pencil. It will take some time to make a budget, so allow yourself a couple of hours to really get all your numbers together and to put them into the budget. There is no need to spend a ton of money on special planner or organizer just to get started on a budget. Try out your budget for a couple of months and figure out your goals and what budgeting style you like best, before spending a huge amount of money.

What do you need to make a budget?

Besides the paper, pen/pencil, and the calculator on your phone, all you need is your paychecks and your bank statements. If you deal primarily in cash, you will need to gather up some receipts to get an idea of how much you spend.

Making a budget is a very eye-opening experience if you have not done it before. People tell me all the time that they did not realize how much they make, how much they spend, and where their money goes every month. I have one friend that didn’t even realize that her basic expenses were not covered by her income and that is why she was constantly racking up credit card debt.

If you tend to get overwhelmed easily especially when it comes to money, just break up your budget road map into multiple simple steps.

How should a beginner start a budget?

The reason I call this a Basic First Budget is because a first budget is just to give you an idea of the money coming in every month and the amount of money going out every month. We are not getting into debt repayment strategies or savings plans yet. We are simply trying to figure out where the money is going every month.

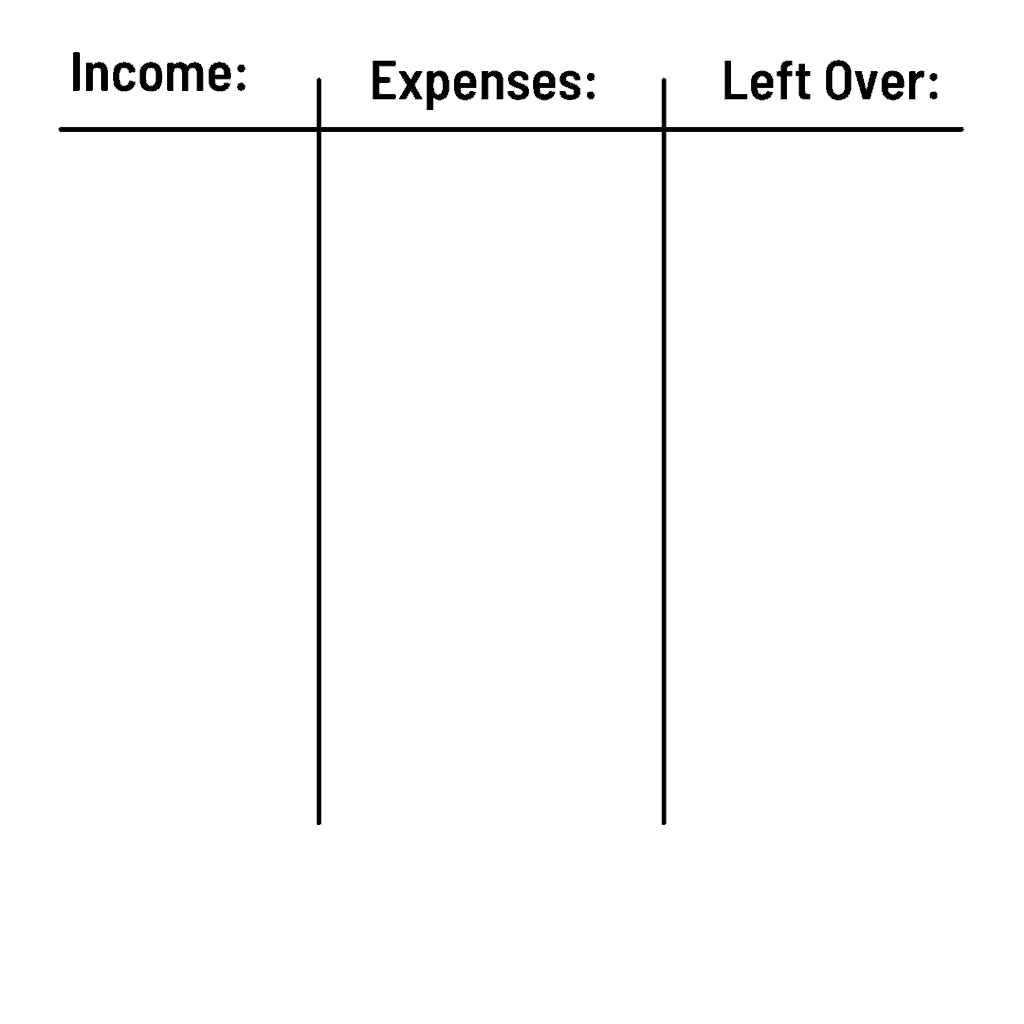

Step 1 – Outline your roadmap

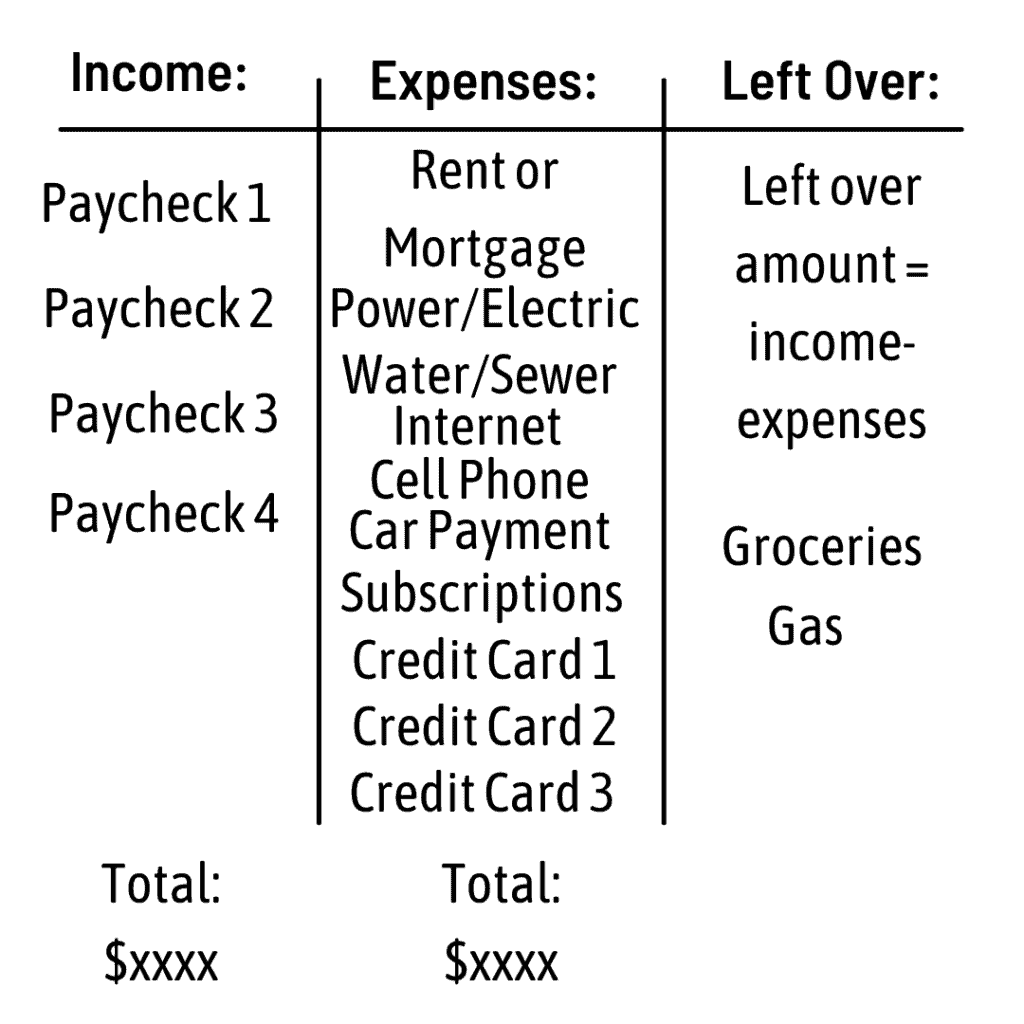

All you need to do is make 3 columns on your sheet of paper. At the top of each column, I want you to label the first one as income, the second one as expenses, and the third one as left over.

Step 2 – What is your income?

You will need to gather your paychecks for the last month. I would go by the date the check is written and not by the week or weeks you are getting paid for on that check. That gets really confusing, and we are trying to stay simple. So for example, my family is a one income family and my husband is the only one with a paycheck. He gets paid every week so for a standard month he will get 4 paychecks a month. So in the income column, I will put his 4 paychecks and total it up at the bottom.

Step 3: What are your bills?

Next I want you to write out every bill that you pay every month. This will be rent/mortgage, electric bill, water bill, cable, internet, subscriptions (streaming, amazon prime, etc.), car loans, credit card bills, medical bills, and anything else you are sent a bill for and have to pay monthly. We are not looking at any expenses that fluctuate yet, this section is just for your standard monthly bills. Under the loans, credit cards, and medical bills you will list just the monthly minimum. Even if you pay over the minimum every month, I want you to just list the minimum payment amount. Write the total of all the bills at the bottom of the column.

Step 4: What are your variable expenses? (Left Over Column)

The Left Over column is all about seeing what money is left over after the standard monthly bills are paid. I am really hoping that when you take your income and subtract your minimum monthly bills, that there is money left over.

If you are in the negative at this point, you do not make enough money to support your minimum expenses. This means you will need to seriously decrease your minimum expenses, or you need to make more income.

Once you have an amount (income minus expenses), I want you to place it at the top of your Left Over column. This is the amount that you will need to use for your variable expenses like groceries and gas.

Example Budget with Real Numbers

This next image is of an example budget with real numbers written in, so you can get an idea of how this basic budget works. This left over column is where all your choices come from and is really the basis of your future financial freedom.

In case you are wondering, this sample budget is actually a real budget for my family from a couple of years ago. I have rounded all the numbers to make it easier to read.

My husband had 4 paychecks a month for a total of $2400. Our fixed monthly expenses were $1418, and that left us with $982 in our Left Over column. Our variable expenses are typically just groceries and gas, and we averaged about $100 a week in groceries and $50 a week in gas. The total of these variable expenses equals $600, so that brings our Left Over column down to $382. That pink box that is highlighting $382, is just how much money we have to play with every month. I chose pink because this amount left over is not good or bad, it is just what it is.

This $382 is all that is left to go out to eat, go see a movie, buy a new toy, or anything else for the WHOLE month.

Why does the pink box matter?

The pink box on the budget road map, is truly the only amount of money that you get to decide per month how exactly you want to use it. Now for most low income families like mine, this pink box number will be pretty low. If your pink box amount does not seem low to you, then you are in a good financial spot.

This pink box amount is what usually upsets people the most. You can make very good income every month, but when you subtract your minimum monthly bills and your variable expenses like groceries and gas, the final amount can really surprise you.

For more real-life examples, check out “How can I live on $500 a month after bills?” to learn some ways to make the most of the money left after bills.

What is a Bare Bones Budget?

This very simple budget is also known as a bare bones budget. This budget is a snapshot of what the bare minimum amount of money you need every month to pay all your bills and variable expenses. In the example that I showed, if you take the total amount of the monthly bills ($1418) and add it to the variable expenses ($600), this will total $2018. I need to make sure no matter what that we have $2018 coming in every month in order to pay all our bills and to have food and gas. I am not counting the extra $382 that is left over in my bare bones budget, because it does not have a specific use right now.

If you are still struggling, check out “9 Common Myths about Budgeting” and “8 Biggest Challenges of Sticking to a Budget“. Both of these articles will help you tackle the biggest obstacles to keeping and staying on a budget.