Weekly Christmas Money Savings Challenge (random amounts)

Every year 40% of American will take on debt to pay for Christmas gifts and decorations. It has become a normal cycle of paying for holiday related purchases on a credit card and then taking 6 months to pay it off.

If we flip the cycle of going in debt for Christmas and taking 6 months to pay it off, we can save for a few months ahead of time to have money to spend for Christmas. By saving money early for Christmas, we avoid paying high interest and fees. Using a Christmas Money Savings Challenge will jumpstart your savings and help you be more aware of your spending!

No Money for Christmas

Every year, families are faced with a sad realization that there is no money for Christmas gifts and decorations. We take out personal loans, payday loans, and title loans to pay for holiday spending that we didn’t prepare ahead of time for.

By taking small steps earlier in the year, we can save up the money needed to celebrate Christmas and not take on debt. These personal loans, payday loans, and title loans charge huge fees, incredibly high interest rates, and can cause further financial ruin if we miss any payments.

How to create a Christmas Budget

The easiest way to make a Christmas Budget, is to look at you’re spending from last year. Get out your credit card statements and back account information from November and December of the previous year.

Make a list of all purchases that were made and put them into categories like gifts, travel, decorations, and food. These are the main 4 categories that we spend in around the holidays, but you may have different categories depending on how you and your family celebrate.

Once you know the total amount spent and what you spent it on in each category, you can start to make some decisions. Did you feel that you spent too much last year overall? Did you go a little crazy in one category?

Once we know what area we would like to fix we can take action. For example, if you spent a total of $1000 dollars last year like most Americans do, then you can determine that you want your budget this year to be less than that.

If out of that $1000 you spent over $400 just on food for Christmas parties and gatherings, than you may want to look at cheaper foods and drinks to serve this year. Maybe your gift category was way too high last year, then this year you can set a limit amount for gifts for each person.

When you make a budget and you put limits on each category, you can now start to make a plan to make this budget successful.

Frugal Christmas Budget

Maybe this past year you have experienced a job loss, or the family is making less income. This has been happening to a lot of families due to different factors like working from home, higher costs of daycare, and not getting annual raises.

The biggest part of Christmas is spending it with family. Your kids and loved ones do not need huge gifts and expensive experiences to celebrate Christmas. There are plenty of ways to have a fabulous Christmas on a budget.

How to spend less money on Christmas

Sometimes spending less money on Christmas means thinking outside of the box. Most of us get so caught up in the buying frenzy that starts on Black Friday, that we don’t really look at how much we are spending in total. Let’s look at some tips to lower our 4 cost categories of gifts, travel, decorations, and food.

Save Money on Christmas Gifts

This year let’s set a limit for each child. Then we will go a step further and either set a limit on gifts for extended friends and family, or we will skip them this year. Even though it is nice to give every cousin, aunt, uncle, and work friend a gift, these can all add up to hundreds of dollars. You can tell extended family up front before the holidays begin, that you will just be doing presents for kids or that instead of individual gifts you will be giving each family a gift.

Instead of waiting till the 4th quarter to purchase Christmas presents start looking year-round. I have found amazing gifts for kids and adults during Clearence Events in Spring and in Summer. One year we gave each of the families with small kids inflatable pools in fun shapes that only cost us $5 a piece! (these pools went on mega clearance at the end of summer, and we scooped up pools shaped like ice cream trucks, pirate ships, and other fun themes). Another time, we gave each family a movie night gift box full of candy, popcorn, and cozy blankets.

Save Money on Holiday Travel

Lots of families travel hundreds of miles to visit other family members like grandparents every year. These costs can really add up when you include flights, hotel rooms, gas for driving, and eating out. This year we may want to wait to visit family at another time that doesn’t charge a premium for travel. Or we can start a new tradition of only traveling every other year. We can also suggest that this year family come to visit us at our home.

Other ways to save on traveling is to prepack snacks and easy foods like sandwiches instead of having to buy fast food or at sit down restaurants. We can also look into ways to save on hotel expenses by using sites like AirBNB, VRBO, and other short stay options. After seeing how much money we saved using short term rental options, and how much better it was for having a family of 4 in a bigger space than a hotel, we may never stay at a hotel again.

Save Money on Christmas Decorations

Decorating for Christmas is a time to show off your interior design skills as well as set the tone for Christmas. Some families go all out with not only inside decorations, but also huge yard displays. If this sounds like you, then keep reading for some tips that will blow your mind!

If every year you love to purchase new stockings, ornaments, and yard displays, I want you to start exploring your local thrift shops in Spring and Summer. During Spring and Summer time, people tend to clean out their houses and attics and get rid of these items. Unfortunately, there are so few people buying Christmas stuff in warm months, that these 2nd hand stores are forced to charge pennies on these items just to get rid of them to make more space.

Every year, I see barely used Christmas Trees, brand new in package Christmas decorations, and huge blow-up yard displays for pennies on the dollar at places like Goodwill and thrift stores. If you love to decorate, then you need to start shopping during the off season.

If you spent $200 last year on decorations, you could easily cut that in half this year and get everything you need by buying during the non-peak times.

Save Money on Christmas Food & Drink

You are the “hostest with the mostest” every year during the Christmas Season. You love to host huge dinners and have amazing parties for friends and family members. That is awesome, and if you love it, you should totally keep doing that.

This year let’s preplan those menus and make the most of some budget friendly options for appetizers, side dishes, and cocktails. Pinterest is full of money saving tips to make Christmas party food on a budget.

For family gatherings, we can also go potluck this year where every family is in charge of bringing part of the meal. This way one family isn’t footing the bill for the whole dinner.

Do you go out to eat for a huge family dinner? Consider ordering in or making the feast yourself this year!

Making Extra Money for Christmas

The best Christmas and one that you won’t have buyer’s regret on will be the one that you can afford and don’t have to pay interest on. When you look back at previous Christmases do you remember the really crazy expensive things that you bought? Or do you remember the fun times you had with friends and family?

If you find yourself needing to make extra money for Christmas this year, consider doing a house clean out. Every year at the end of summer, we start going through toys and items in our kids’ rooms. Not only do they outgrow toys and books every year when they are young, they also lose interest in them.

We try to cycle toys and books around throughout the year, but some toys just never really catch their eye and are rarely played with. These barely used toys are perfect to put up for sale! Have a yard sale, put them up on your Facebook page, or use a market page like Mercari or Depop.

Over the summertime is also the perfect opportunity to volunteer your babysitting services out to friends and family. This is a win-win situation for most because you get a little extra money, and your kids get an extra friend to play with all summer long.

Do you have crafty skills or a great eye for design? Consider opening an Etsy store or look into Print on Demand with Merch by Amazon.

Christmas Money Savings Challenge

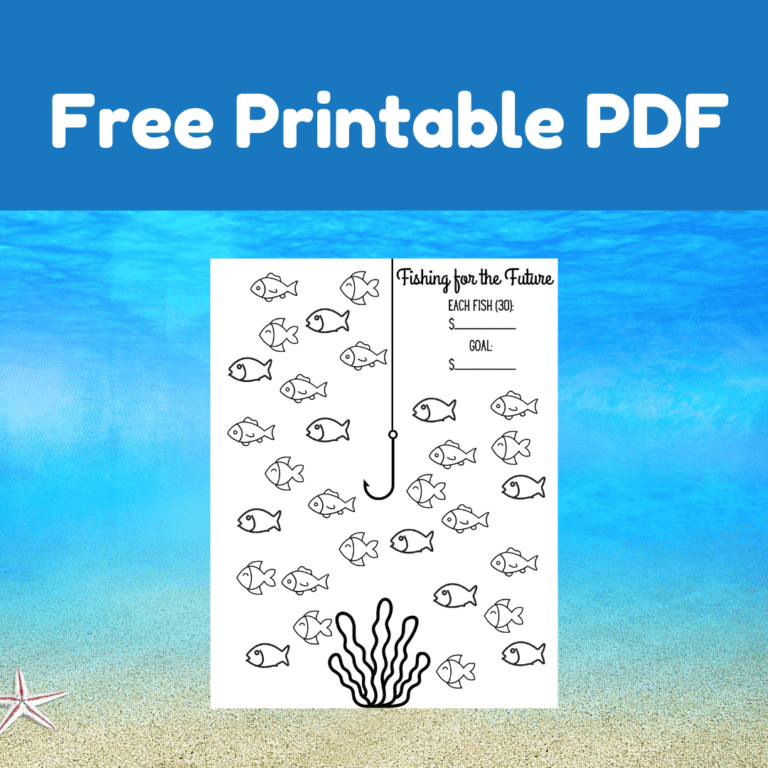

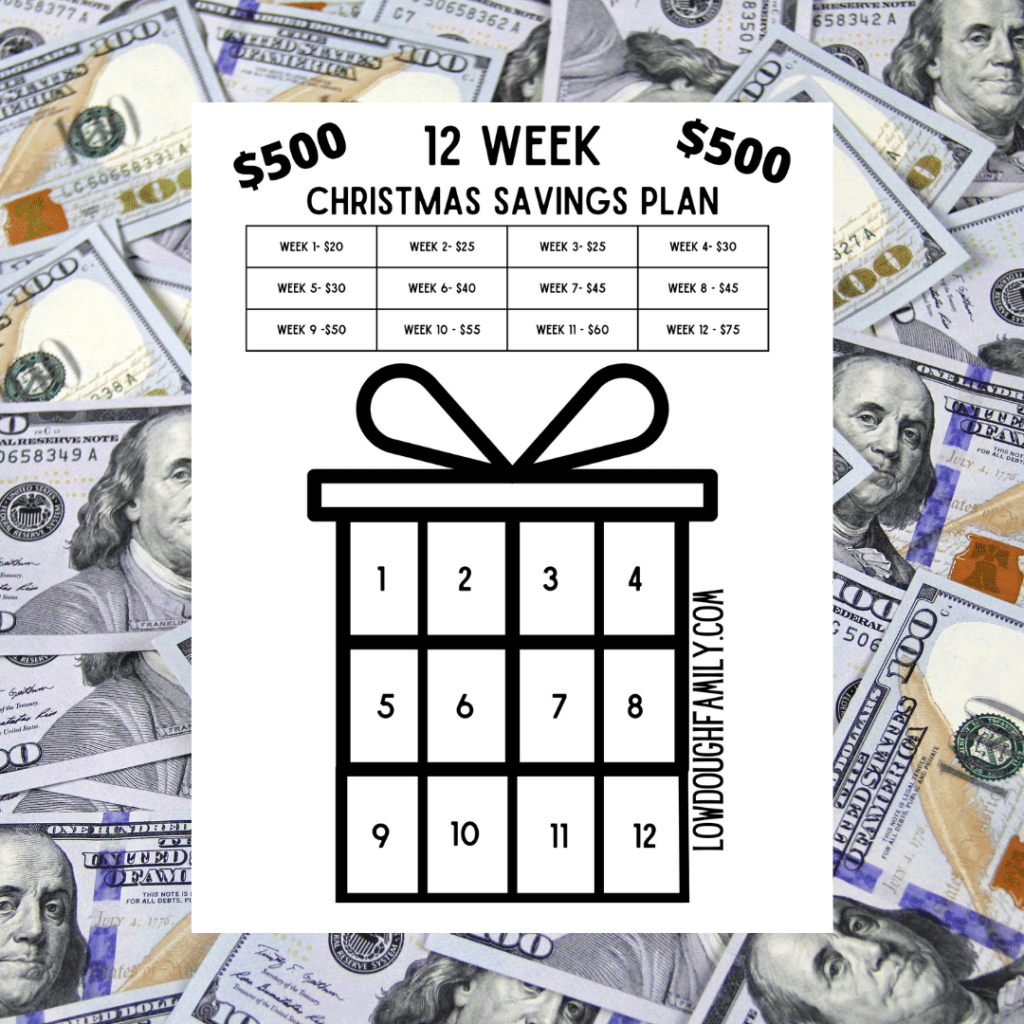

This free printable Christmas Money Savings Challenge is available in 3 amounts: $300, $500, or $1000 goals. You can pick one or combine 2 or 3 to fit the goal that best meets your Christmas Budget.

This is a PDF file, so you will need a PDF reader like Adobe to open the file. Each page is designed to fit on a standard 8.5 x11 inch piece of paper and can be printed on any home printer. No special equipment is needed, and you don’t have to print it at a specialty shop or office supply store.

Each 12-week plan has varying amount to save each week, so some weeks may be more challenging than others. I think the random amounts keep it more interesting and I am more likely to stick to my goal by really challenging myself!

If you are not a fan of random amounts per week, and would prefer fixed amount plans, check out this 12-week Christmas Savings Plan.

Every week you will save the amount listed, and then color in the coordinating box when completed. Once all the boxes are colored in, you will have hit your goal for your Christmas Budget.

In order to have enough time to do the 12-week Christmas Savings Challenge, you will need to start in September!

Please feel free to share this free printable with friends, family, and co-workers. I only ask that if you share it on social media that you give LowDoughFamily.com the credit for creating it.

Happy Savings!