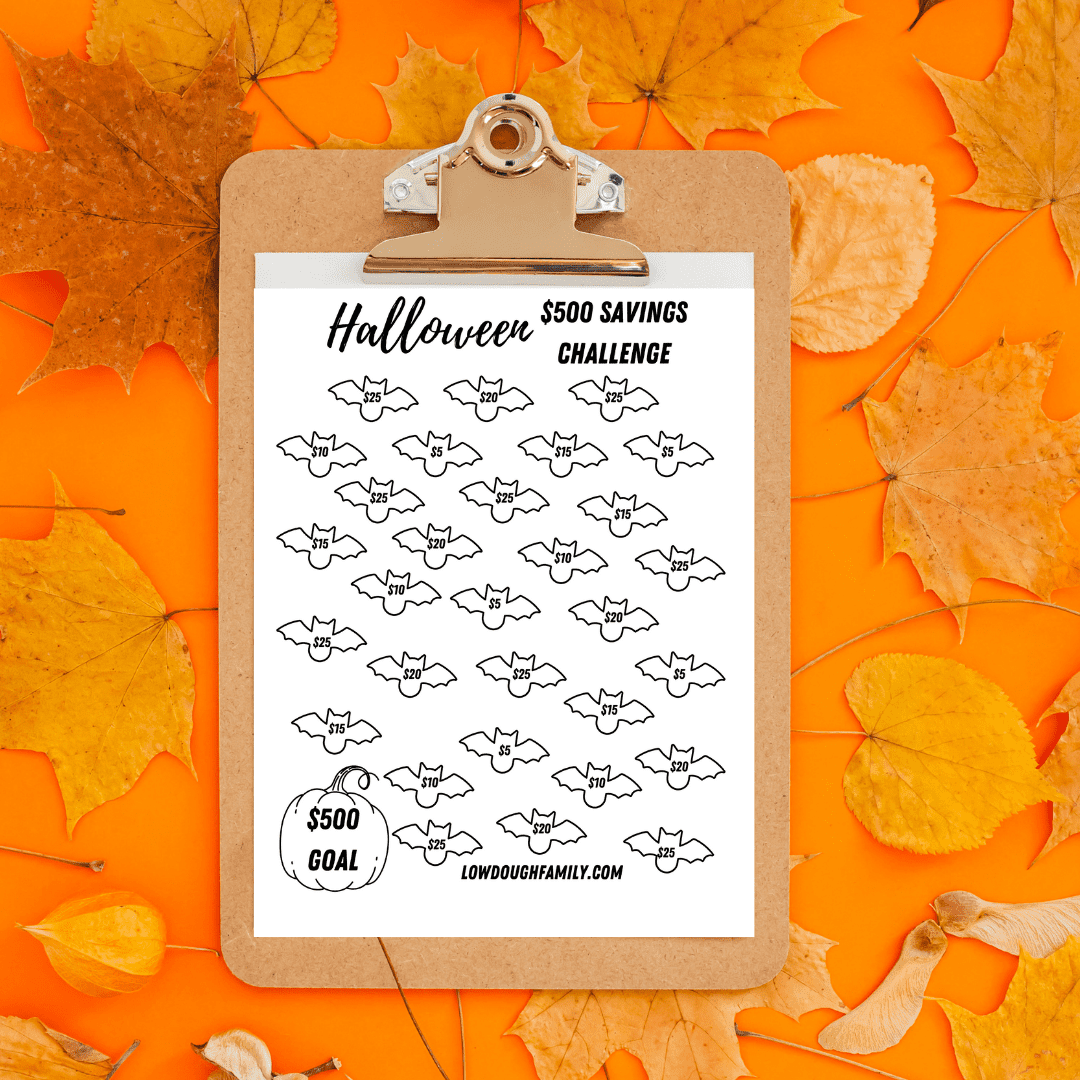

Halloween 500 Dollar Savings Challenge

Pumpkin spice is in the air, and the money is flying out of my wallet! It never fails that when Autumn starts that all the really cool events around our town does as well.

Saving 500 dollars doesn’t have to be a last-minute thing. You can plan ahead and have 500 dollars ready for whatever you want to use it for, almost like a 500 Emergency “Fun” Fund.

Now that my children are getting older, they want to do the pumpkin patches, corn mazes, and sip hot cocoa by a fire pit in the month of October. In previous years, we just did a little trick or treating, and they were satisfied, but this year I plan to go BIG!

My youngest can walk and keep up with us, so we are going to start hitting some fall festivals and Halloween events. We live in a small town that does put on some events for free, but there are some extras that we have to pay for ourselves.

I don’t really intend on spending $500 just on Halloween, this money will really cover the whole month of October and November family fun, plus a few little expenses like car tags too.

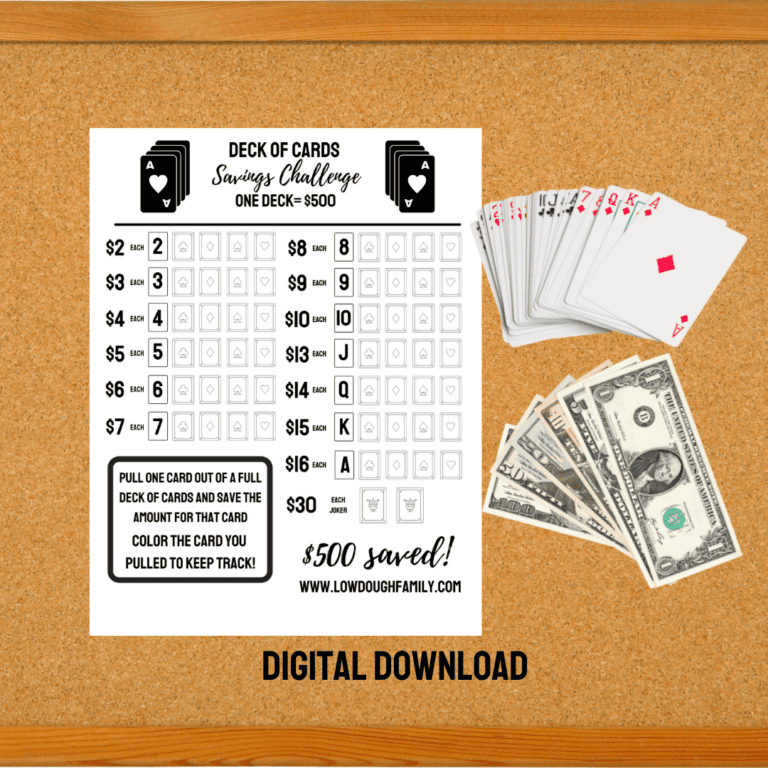

How does this Savings Challenges work?

This savings challenge is set up for 30 days or however long you want to do it. The chart includes 30 bats that are all assigned a dollar amount ranging in $5 to $25.

Every time you can save the amount on a bat, you will color it in. Once all the bats are colored in, then you will have hit your goal of $500.

All of our savings’ challenges are designed to be fun and stress free. We have no hard fast rules, and we believe every family saves differently and that is just fine.

I share what I plan on doing with each challenge to give you some inspiration on what you can do with your challenges and hopefully you will pick up some tips and tricks along the way!

My Savings Challenge Plan

I will probably not do this one over a one-month period. I plan to put this printable in my budget planner, and any time I have an extra $5-$25 I will put it towards this challenge. I like to put my challenge trackers in a clear page protector, and every time I have money for the challenge, I put it in the pocket that holds that challenge. Super easy and I don’t have to keep track of a bunch of envelopes for different challenges.

Once the challenge is completed, I deposit the money into my checking account just for sinking funds, and then I can use it as needed. I also have a very simple Google Sheets that I set up for all my savings categories and just write in what I used, so it tells me how much is left over.

This is the system that works best for my family, but your savings challenge plan may be very different. You can put your money in an envelope, a jar, a box, or your savings account.

The important part of savings challenges is to get in the habit of saving for expenses ahead of time. I will start working on this challenge from about mid-May through September and save a little bit here and a little bit there.

If I have any money left over from this savings challenge, I will move it over to an area that needs attention. I like to save more than I expect to use, so that way if something comes up, I should be able to cover it!

Why Should you do a Savings Challenge?

Every month, I see people struggle with unexpected expenses or expenses that creeped up on them. When we wait to save for an expense in the same month it is due, we leave ourselves a huge margin for error.

I would rather plan way ahead and have that money ready for when I need it, rather than to worry about expenses that are coming up. The path to financial freedom is not making a ton of money, even though that does help, the path is lined with preparation.

When we anticipate expenses and we work to tackle them ahead of time, our margin of error becomes very tiny. I have also found that having a specific goal in mind before I start saving helps me to stay on track and want to save.

For example, if I end up with $15 leftover in my grocery budget one week, I may be tempted to buy a new sweater that I may not really “need”, or I can put that $15 towards fun times with my kids. It ends up being a no-brainer, because I would much rather have fun with my kids than have a sweater.

Now if I had made the choice between buying a sweater and putting it towards a savings account, it doesn’t give me the same easy feeling of choosing. When we pick exactly what we are saving for like family fun, that triggers my emotions.

A generic savings account set aside for a large amount with no real plan, doesn’t really make me want to throw money at it. This is why I love savings challenges; I can plan for what I want to do, set up a goal, and really knock it out.

Maybe you just found out your pregnant and need to save up money for furniture for the nursery. This is a great saving goal and easy to tackle with a tracker. For more information about “When to Buy Nursery Furniture to Save Money” this article can be really helpful!

I’m naturally a planner, but I can really lack motivation and stamina for huge goals. Savings Challenges are easy to see your progress and therefore you feel more motivated to complete them!

If you do have a huge goal, try using your savings challenges to save up part of the overall goal. For instance, you can break up your large goal into 10 smaller goals, or 12 of them for each month in a year.

Free Printable Savings Tracker Download

Each Savings Challenge or Tracker is a PDF file so will need a program like Adobe to open in. Just simply click the download button, and then open the file.

Each Sheet is designed to be printed at home on a regular 8.5-inch by 11-inch paper. You don’t need any fancy paper or equipment, just a regular home printer will work fine. We also make everything in black and white, so it won’t use up all your color ink.

Please feel free to share this savings tracker with friends, family or co-workers. If you share it on social media, we would love for you to give the credit to LowDoughFamily.com.

Happy Spooky Savings!