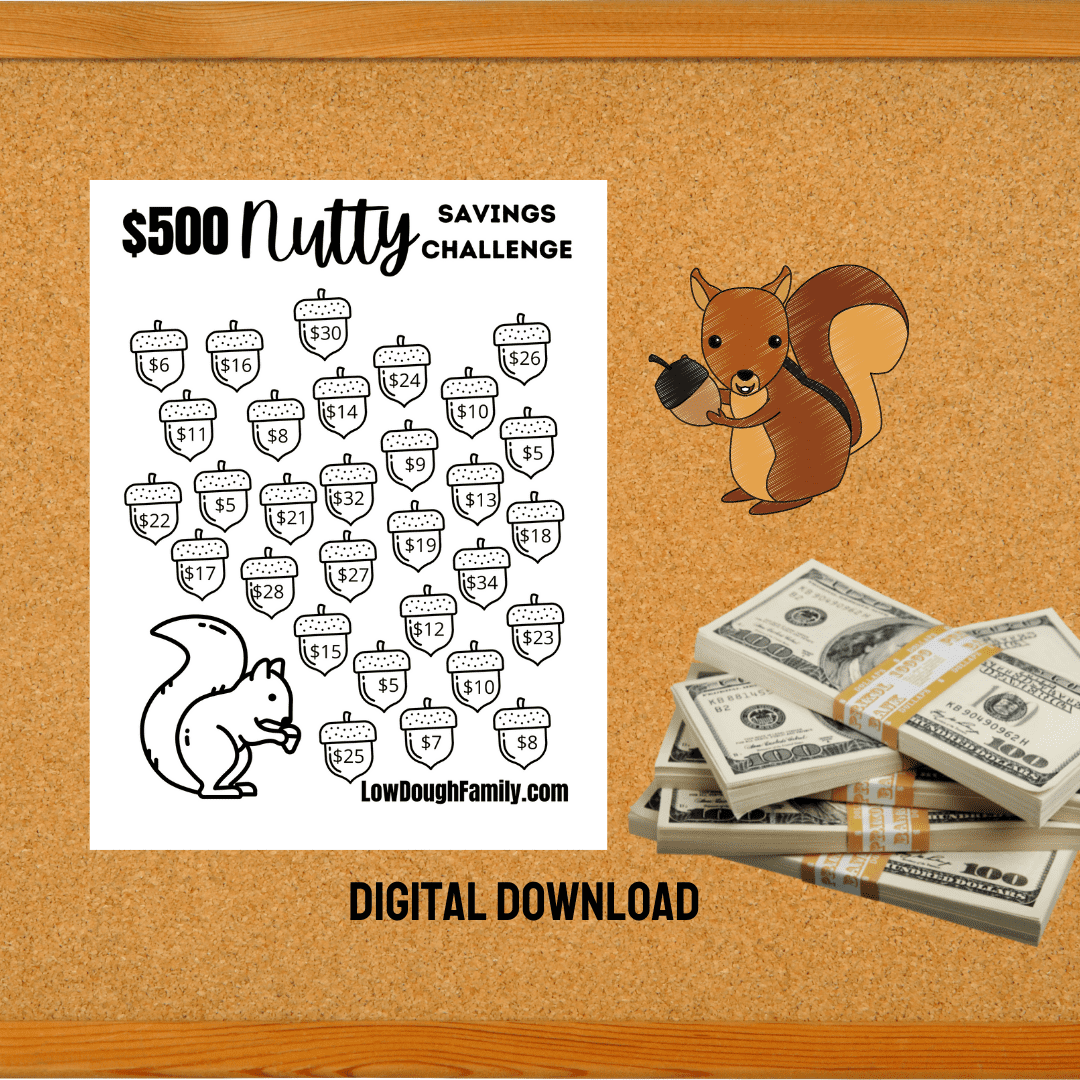

500 Dollar Savings Challenge (Free Printable – Nutty Squirrel)

This summer, my husband and I have quite a few home improvement projects that we want to tackle. I am thinking that $500 will go a long way to fund those projects. So this month we are going to squirrel away $500 in a savings challenge!

When you have a goal of $500 to save up for it can seem difficult. Fun savings challenges make it so much easier to do and help you track your progress. Print out a challenge and place it somewhere you will see it like on your fridge, a vision board, or on your wall. As you complete a day of the challenge color it in to see your progress towards your goal!

How to pick a Savings Challenge Goal

When it comes time to do a savings challenge, I find that I am more successful if I know what I am going to spend the hard earned and saved money on. When I save money without an end plan, I don’t feel as motivated.

The easiest goal to set is to look forward to the next couple of months, and see if there are any holidays/celebration, school or sporting events, household projects, etc.

We want to do some sprucing up around the house now that the weather is warming up, so we are saving for some do-it-yourself projects!

How does the Savings Challenge work?

This Nutty savings challenge is based on a 30 day month and has 30 acorns with varying amounts. The amounts are as low as $5 and as high as $32.

Every time I make a payment to the challenge in the amount seen on one of the acorns, I will color it in to show that day is complete.

I have found that it is much easier to knock out some of the higher amounts first earlier in the month, and then I can coast for the rest of the month!

You can also start with the smaller amounts first and once you get the excitement and accomplished feeling, then you can tackle the bigger amounts.

There are no rules that say you have to do them in a certain order, so work the challenge how it best fits you and your situation. Just don’t give up!

It is better to extend your challenge past 30 days then to quit because you didn’t color in an acorn. Any savings is better than no savings!

We like to use just a cheap white envelope to save up our savings challenge money. At the end of the month, I go deposit it in our bank account.

If you are cashless, you can also just transfer money to your savings account every day. Either way is fine as long as you stick to it and save the $500 in the challenge.

Where does the Savings Challenge Money come from?

Savings challenges to me is all about found money, extra money, or unexpected money. What I mean by that is I don’t want to take away money that is already budgeted to put into my savings challenge.

I like to use money from unexpected overtime, refund checks, side hustle money, and selling unwanted things.

This month I have a check for a class action settlement of $38.07 that will go towards this challenge. I also am selling the last of our baby stuff like playpens, boppy pillows, and a crib.

Any proceeds from selling these items on the Facebook marketplace will go towards my savings challenge for the month.

I also have about $22 that will get paid to me this month from my Merch by Amazon account. This little side hustle isn’t crazy in the payouts, but it barely takes any time at all! If you have a knack for graphic design, you can upload designs for t-shirts that get printed and shipped by Amazon on your behalf and then you collect a royalty when the shirt sells.

Between these small amounts, I will be able to save up to fully fund our household projects. In a way, I feel like these projects will be worth even more because I didn’t have to go into debt to do them.

500 Dollars Savings Challenge

This free digital download is an easy print at home design. It is a PDF file so you will need a PDF reader like Adobe to open it.

The file prints on a standard 8.5 x 11 sheet of paper so you can print it at home on any printer. No special paper needed.

I’m such a dork and I love to 3 hole punch my completed savings challenges. I put them in my budget binder so at the end of the year, I can go back and see what all I accomplished. We usually write at the top of each monthly challenge what we plan to use it for, so it is fun to see what all we have paid for at the end of the year.

Please feel free to share this savings challenge with friends and family! If you decide to share it on social media, please give Low Dough Family the credit for coming up with the challenge.

Happy Savings!