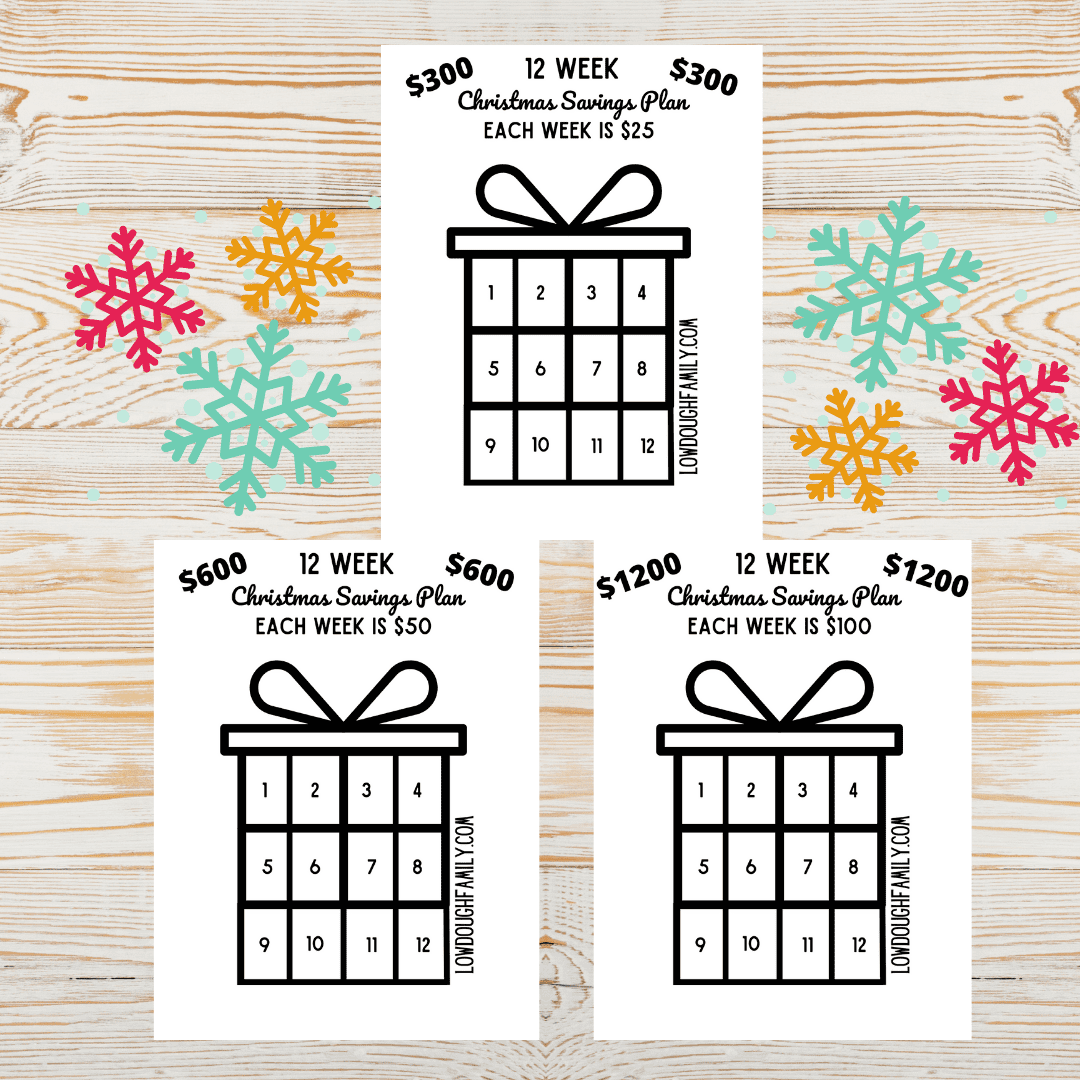

12 Week Christmas Savings Plan (Fixed Amount per Week)

Christmas is such a fun time of year, but it is also the time that we may go in debt to pay for it. We always try to pay for big expenses in cash, so we have a budget and stick to it! Once the cash is gone, there is no more spending.

A 12 week Christmas Savings plan is a great way to save small amounts of money over a longer time period. You will want to start your savings plan no later than September 30th 2022 in order to have your money ready to spend by December 16th. If you want to spend the money sooner, you will need to start your challenge earlier.

How much money is a good amount for Christmas?

The best amount to save for Christmas is the amount that you can afford. I say this because every family is going to save a different amount of money for Christmas.

Families celebrate Christmas in very different ways. Some families have trips, do big gifts, or celebrate on a small budget. There is no wrong way to celebrate Christmas. Personally, I think as long as you spend the time with your family, the rest is just gravy.

I want you to pick an amount that you are comfortable with for your family and that you can reasonably afford. This may be $300 or this may be $2000. These totals would also include everything you spend money on for Christmas like: decorations, meals, presents, and any needed travel expenses.

How do I start a Christmas savings?

First we have to set up a plan. How much do we want to save and for how long? When you know the end result and the time frame that you have to work with you can work backwards to set a reasonable plan.

For example, if we want to save $1,200 over a period of 12 weeks this would come out to $100 a week.

For example, if we want to save $300 over a period of 12 weeks this would come out to $50 a week.

Once we have an amount and a timeframe, then we can work on a plan on how to save this money for Christmas.

How much should I save per week for Christmas?

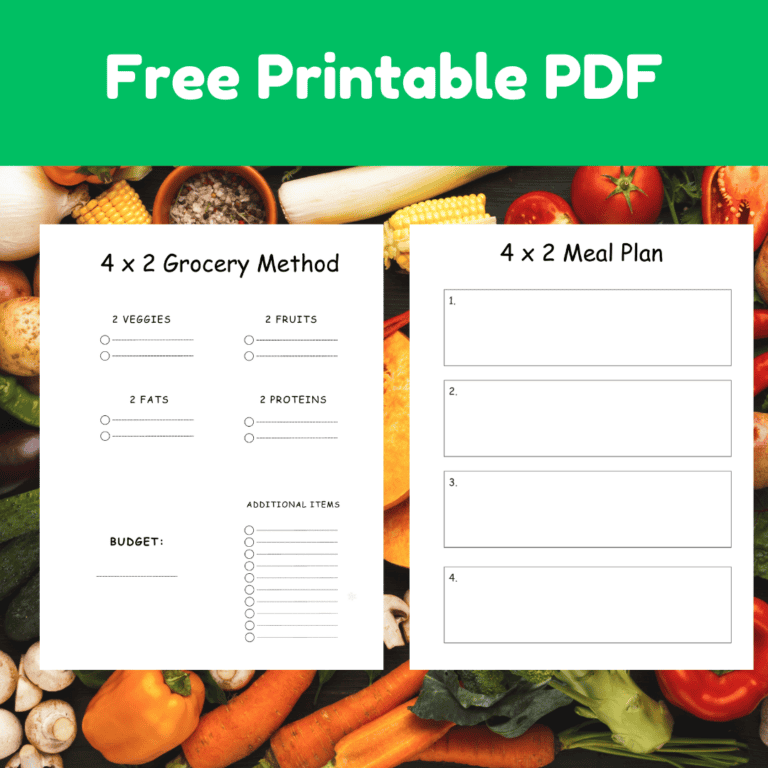

How much you can afford to save per week towards Christmas is going to come back to your budget. Your budget should list your income, then minus your fixed expenses, and this will leave you variable spending that is left over.

This variable spending is also where we spend money on gas and groceries, so don’t forget to make sure those are taken care of first. Any money left over after gas and groceries are funds that are up for grabs!

I like to take this left-over money and apply it to known expenses that are coming up, possible unexpected expenses like car repairs/maintenance, and also towards wants or “fun money”.

We are a family of 4 that doesn’t spend a lot of money on expensive tech gadgets, designer brand names, or eat out very often. These are just not in our money mindset. If you want to learn about changing your money mindset, check out this article, “Value Based Spending & Changing your Money Mindset.”

We don’t usually have a ton of money left over to spend at the end of the month, but we like to use it strategically for things to come. We are very big about preparing for future expenses way ahead of time!

One of the reasons I like a 12 week Christmas Savings Plan is because I feel like I can save smaller amounts over a longer time frame, and not feel so pinched in my budget. If I tried to save $600 in one month, that might be really difficult, but saving $600 over 12 weeks or about 3 months, just seems like a much easier goal to accomplish!

Saving money for Christmas weekly

If you also have a tight budget, then you understand that sometimes there is just not enough left over at the end of the month to save towards goals. This is where extra money and side hustles come in!

Ways to Make Extra Money for Christmas:

- Work Overtime – Volunteer to work an extra shift or stay late a few hours to earn a little extra income each week.

- Sell Unneeded/ No Longer Used Item – We just recently went through all our baby stuff and put it up for sale. We are not planning on having more kids, and our youngest is 2.5 years old now. We no longer needed the infant car seat & stroller, a crib, bassinet, etc.

- Side Hustle – We currently have a few side hustles that we work on like Merch By Amazon, an Etsy Shop, and a Print on Demand Store. None of these make a ton of money, but an extra $50 to $100 a month adds up!

- Part Time Job – So many places are hiring right now and are desperate for part time workers. Check out fast food restaurants, gas stations, sit down restaurants, and retail stores. Most are starting out at anywhere from $12-15 an hour and will work with you to accommodate your schedule. Maybe you can only work a few nights a week or on weekends? Even 1-2 extra shifts a week can make a huge difference!

What’s the best way to save money for Christmas?

The best way to save money for Christmas will be completely different for each family. You really need to pick a way that works for your situation.

For the last few years, my daughter has had special needs and was not able to go to a daycare or preschool, so I really had no choice but to stay home with her every day. I could not go out and get a day job.

Instead of a day job, I started trying out different things that I could do from home and whenever I had time. Some of these side hustles have worked out and some haven’t but at least I can say I tried.

I encourage you to sit down with your spouse and discuss different options that can be done on a temporary or longer if needed basis. If your budget is super tight every month, there are ways to earn a little extra if needed!

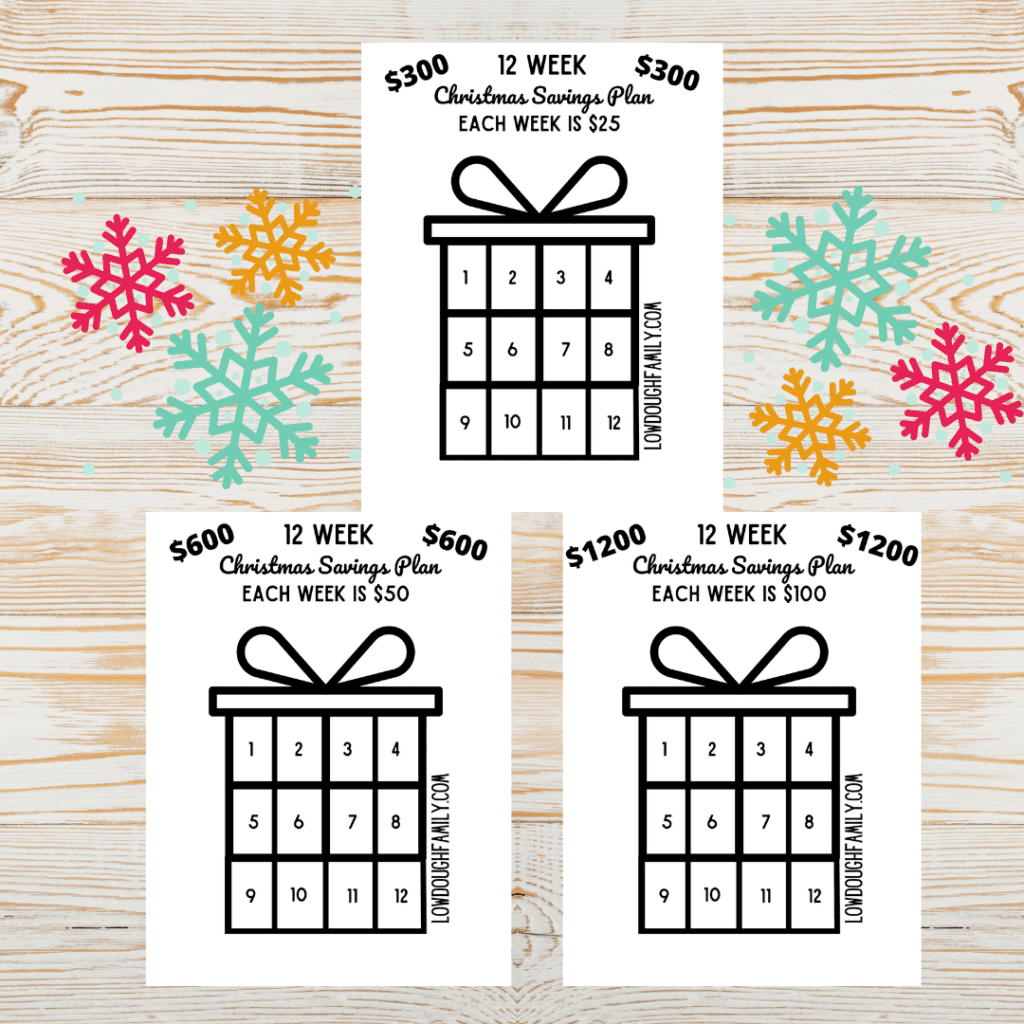

12 Week Christmas Savings Plan with Fixed Amounts

This savings challenge comes in 3 different options, you can save $300, $600, or $1200. Each week has a fixed amount so you will save the same amount every week.

The fixed amounts may be easier because with the same amount every week you can prepare exactly how much you need. When you have random amounts, some weeks may be easier or harder depending on the amount needed to save.

If you would prefer random amounts every week, check out our Christmas Savings Challenge!

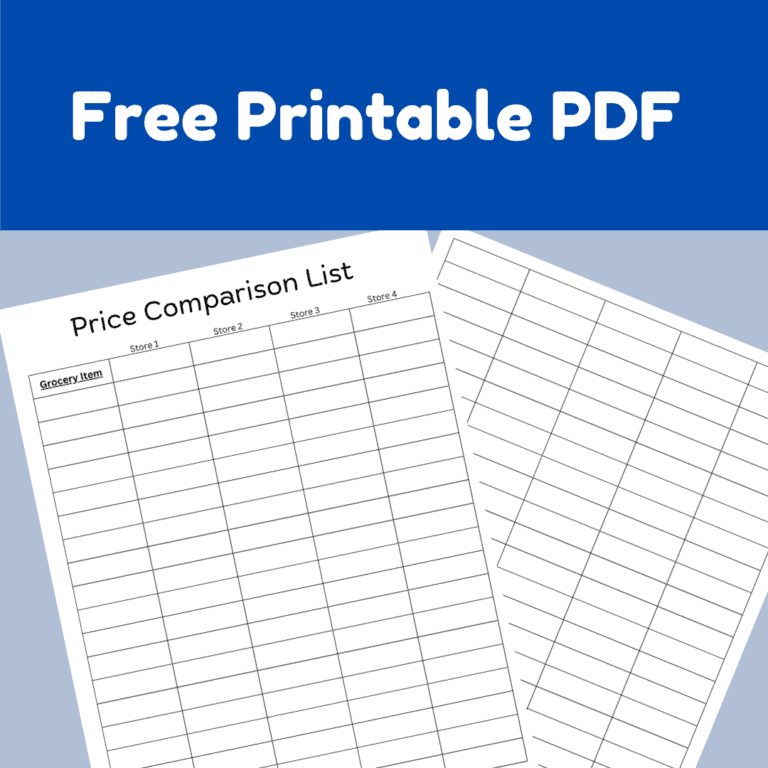

The file is a PDF, you so will need a PDF reader like Adobe to open and print the pages. Each page is designed to fit on standard 8.5 x 11-inch paper, so you don’t need to buy anything special for this challenge. Any home printer will work too!

If you need to save a different amount than $300, $600, or $1200 you can also combine challenges. Like if you plan on saving $900, print the $300 and the $600 pages and you will save $75 a week ($25+$50).

We encourage you to share this savings challenge with friends, family, and co-workers. If you share it on social media, please give LowDoughFamily.com the credit for the challenge.

Happy Christmas Savings!