Grocery News: Target adds Bargain Label Brand

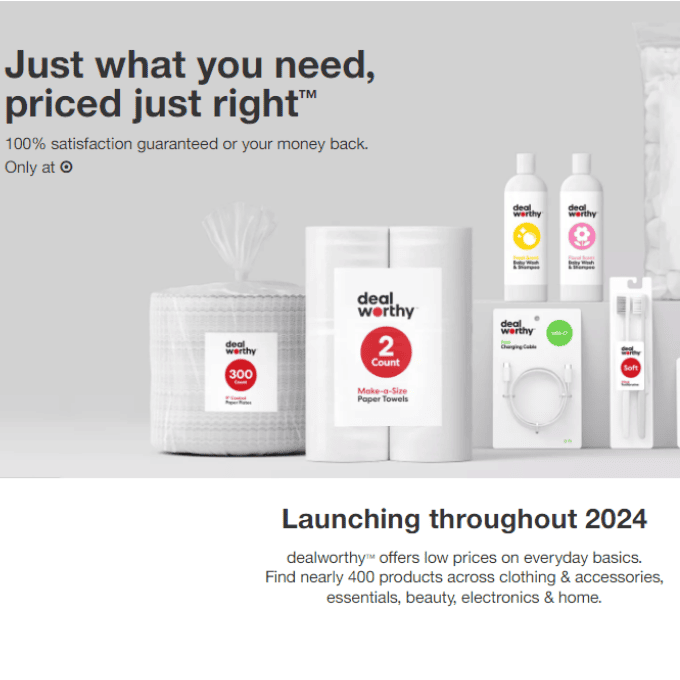

Target recently announced that they have a new private label brand called “Dealworthy” and this is pretty big news. Now Target is actually already home to over 45 private label or “owned” brands.

These Owned brands are all over the store from the electronics area to the grocery section. You will probably recognize such brand names like Up & Up, Good & Gather, and Cat & Jack.

These are all owned and produced by Target, so why is “Dealworthy” a big deal? Well, this is Target coming out with a new bargain brand specifically for bargain shoppers.

Private Label Brands

Now before we go too deep into this, let’s start by covering why stores even offer private label products. Private label products are typically referred to as generics or store brands.

They are an exclusive line just for that retailer to sell and typically it is at a much cheaper price than the National Name Brand.

In a grocery store, you will see store brand items all over the store but especially in the pantry/center aisles, frozen foods, and dairy products.

Now retailers offer private label products to customers as a way of giving more choices as well as getting a higher profit margin. If a grocery store sells a national brand product, they make a profit, but it can be kind of small because the cost to buy national brands is pretty high.

Here is a completely fictious example: ABC grocery store pays $0.70 for a loaf of Blue National Bread. They turn around and sell that loaf for $1.00, so they made $0.30 on that sale.

Now if ABC grocery store starts making their own loaves of bread that only cost $0.15 to make, they can now sell it for $0.75. This means when they sell their own item they make twice the profit ($0.60) compared to selling the national brand, and the customer wins by getting a cheaper price.

Why do they have different levels of Private Label Products?

You may have noticed that over the last 30 years, our grocery stores and major retailers now offer tons more products than ever before.

This leads to bigger and bigger store sizes and a bigger selection for each product category.

Let’s stick with our example about bread. In the past, you may go to the bread section and find 5-6 different brands of bread. Every flavor and size option you could think of that was offered by National Brands.

Over the last 20 years, more and more private label brands have started hitting the shelves. So today, when you go to the bread aisle, you may notice that about half of the breads offered are now store brands but under multiple different names.

Grocery stores first started putting out cheaper products than National Brands, but then realized that they could also compete in the Specialty Products category. This would be items that are made with organic ingredients, unique flavors, different shapes, or really anything premium.

So now a lot of grocery stores offer a basic store brand label that is typically cheaper and a premium private label that is more expensive. This gives the retailer twice as much space on the bread aisle, so they have a higher chance of selling their own products.

Now that inflation and rising costs have made more customers very price aware, grocery stores are now offering a “budget” or “bargain” option.

So now when you go to bread section you may see: premium private label, national brand, store brand, and now bargain brand.

Yes, the consumer is getting more choices and more prices to choose from, but this also means that retailers are even more likely to sell their own products instead of the National brand products.

Target mimicking Kroger?

You may have noticed that Kroger quietly released a new bargain brand in 2022, that has about 150 products labeled as “Smart Way.”

These bargain products are mostly found in the canned foods, bread aisle, and other nonperishables like salad dressing, pickles, and even soap.

The Smart Way brand immediately took off in sales, and is now the fastest growing private label brand in the US. This is clear evidence, that given more choices and lower prices, customers will buy it.

I feel like Target has taken a look at Kroger’s brand strategy and decided to launch their own version. Their new “Dealworthy” brand is hitting stores this year and will initially have about 400 products.

You more than likely will see these new items in the household and beauty areas right now, but you can expect to start seeing more of these items in other area in the next few years.

I expect that you will eventually see this in their grocery section. They already have food brands like Good & Gather and Market Pantry, so it makes great sense to add Dealworthy to this section for a lowest price option.

Downside of Private Label Brands

Now more choices and lower prices are typically great things for customers. The only downside is that private labels brands come with their own issues.

Since they are made by the retailer, their prices can be lower to start with, but they can also change prices very quickly and charge more.

We have seen this happen with retailers like Kroger. Their Kroger store brand items used to be much cheaper but have definitely gone up in the last few years. Not just due to inflation, but just in pricing strategy.

Another downside to private labels is that typically they are knock-offs or copycats of best-selling National Brands. Private labels don’t really innovate their own products, they make duplicates of products that are selling well.

Part of this is why reinvent the wheel? If National Brands spend tons of money coming up with new and exciting flavors, then retailers can keep an eye on what sells and remake it. If a product does not do well, then the retailer won’t bother making a similar product.

Now some private label products actually taste better than the National Brand, but in some cases like cereal it’s not quite the same. Still tasty and worth the price, but the private label just doesn’t hit the same way.

Another, not so great trend, is that private label products can be smaller or less in quality than the National Brand. Similar to shrink-flation, retailers often offer smaller sizes in comparison to the big names, and some private labels use lesser quality ingredients.

Food for Thought

So, while I am always happy to see more variety and better prices in the aisles, this is simply one more marketing strategy for major retailers.

The more private label options and products on the shelf, means that retailers make more profit. Now I don’t feel bad that they are taking profit away from huge corporations like Kraft or General Mills, but I do wonder if this will keep large companies from exploring new products.

See everything in retail works in cycles. If private labels sell better than National Brands, then National Brands can’t afford to spend lots of money on creating new flavors and new innovations in food.

Ever notice when new flavor hits the market, it typically is put out by a National Brand? That brand paid tons of money in research and development to create that flavor, test it in focus groups, and then market that flavor to the general public.

Do you remember when Bacon flavor was released by a major potato chip maker? It was all over their commercials, coupons & sales were offered to try the flavor, and lots of marketing money was spent to inform you that this was a HOT new flavor.

Within a very short time, that Bacon flavor was everywhere not just in the chip aisle. Now lots of different manufacturers are trying that flavor out on crackers, popcorn, ice cream, cupcakes, and coffee creamer.

Whenever National brands have a hit new flavor, private labels jump right on the trend. So, if National brands can no longer afford to come up with new flavors, the average customer could start seeing less and less new options to try.

Which in turn means, private label brands will have less new products to sell at a cheaper price…..